Introduction

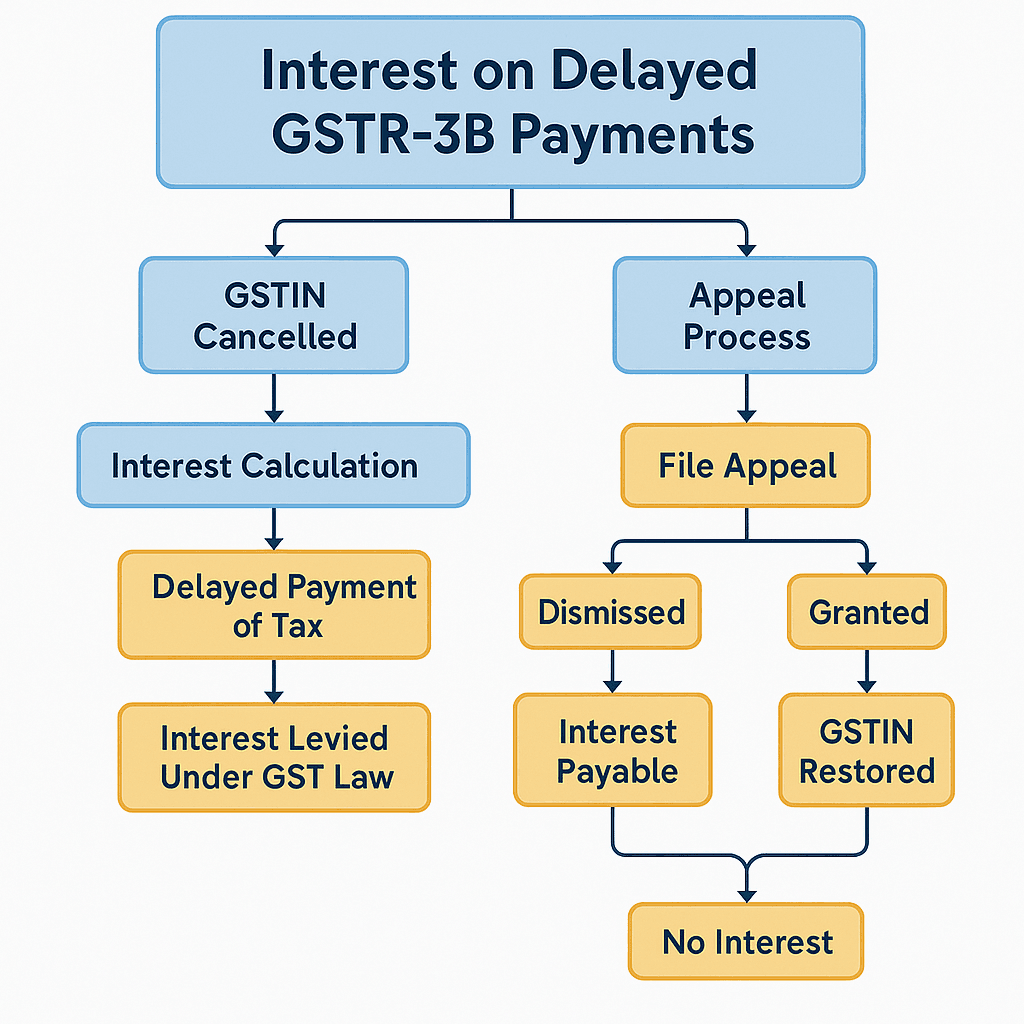

When your GSTR-3B delayed interest liability arises from a suo moto GSTIN cancellation by the department, you face a complex challenge. You cannot file returns while your registration is cancelled, yet statutory interest under Section 50 continues to accrue. This post explains the legal mechanics, judicial relief, and the best path—pay first and appeal later or challenge outright.

What Is GSTR-3B Delayed Interest?

Under Section 50 of the CGST Act, interest accrues from the day after the return due date until payment. Even during pending appeals or writ petitions, the liability remains automatic and mandatory. Thus, when a court criticizes the department’s misstep, it sets a strong factual groundwork to contest interest, but it doesn’t suspend the charge itself.

Grounds to Challenge Interest

Delay Caused by Departmental Action

Since the High Court condemned the suo moto cancellation—and restored GSTINs—taxpayers can argue that the delay was beyond their control. Courts have recognized that interest shouldn’t be punitive when delays stem from administrative defects.

Equity and Fairness Principle

Judicial criticism creates an equitable basis to seek relief. Case law, like Srinivasa Stampings, emphasizes that interest should reflect only the cash‐paid portion, not credits subject to litigation.

When to Pay vs. When to Appeal

- Pay & Reserve Rights:

- Pros: Avoid further penalties and departmental notices.

- Cons: Locks in cash flow until you secure a refund via appeal.

- Prompt Appeal Without Payment:

- Pros: Upholds the taxpayer’s stance on causation.

- Cons: Risks additional interest and penal orders if appeal is dismissed.

Step-by-Step Appeal Strategy

- File Appeal within 30 days of interest demand.

- Cite HC Criticism and related judgments in the challenge.

- Stay Interest (if possible): Request a stay on interest pending appeal.

- Provisional Payment: Consider partial payment of interest on uncontested periods.

- Monitor Tribunal Orders: Adjust your position based on stage-wise relief.

Conclusion

Timely action matters. If you face GSTR-3B delayed interest after wrongful GSTIN cancellation, appeal quickly and consider provisional payment to limit penalties.

Ready for expert help? Contact our GST specialists today for a tailored appeal strategy and safeguard your cash flow.

Stuck somewhere?

Disturb us to help you out!

Harshaditya Kabra

+91-88277-53530

https://www.linkedin.com/in/ca-harshaditya/

https://accorgconsulting.com/