Introduction

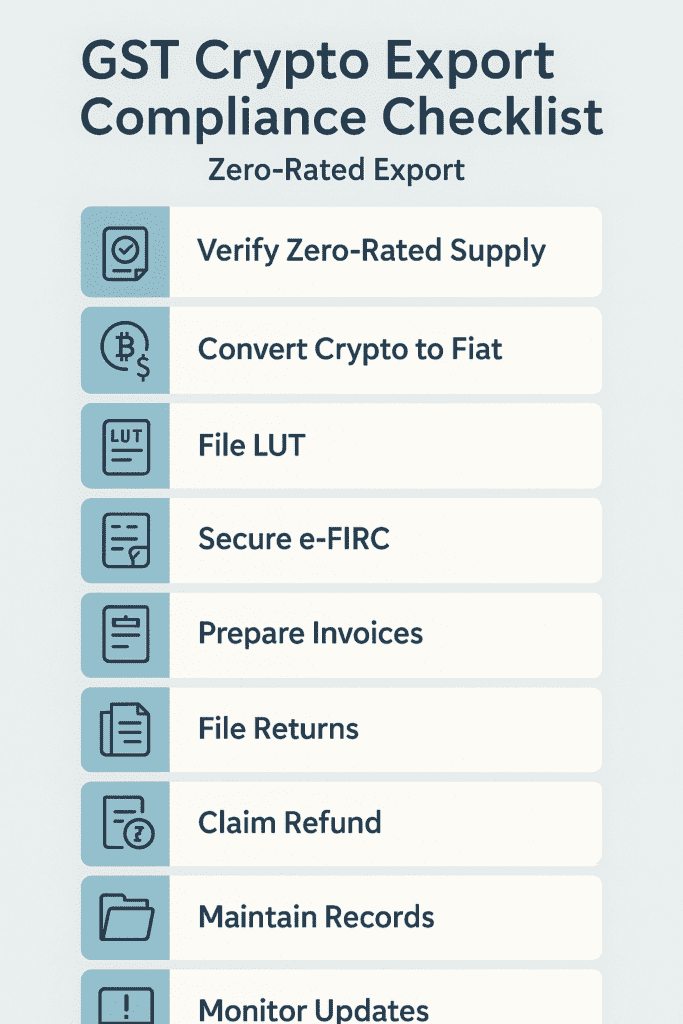

GST crypto export compliance checklist helps exporters confirm zero-rated eligibility, even when accepting virtual digital assets. Therefore, you must convert crypto into convertible foreign exchange and secure proof to benefit from zero-rated exports. This guide walks you through all critical steps, so you file accurately and claim your refunds smoothly.

Verify Zero-Rated Supply Conditions

- IGST Act § 2(6) Definition: “Export of services” must meet these:

- Supplier in India.

- Recipient outside India.

- Place of supply outside India.

- Payment received in convertible foreign exchange.

- Supplier & recipient are distinct persons

- Zero-Rated Supply: Exports under GST are “zero-rated” (0% tax) if conditions are met

Convert Crypto to Fiat

- Crypto Non-Recognition: RBI/FEMA do not recognize cryptocurrency as foreign exchange; banks can’t issue FIRC on crypto

- Active Step: Route virtual asset receipts through a regulated exchange or AD bank. Then convert into INR/foreign currency

File Letter of Undertaking (LUT)

- Why LUT? LUT exempts exporters from paying IGST upfront, letting them claim refunds directly

- How to File: Submit Form RFD-11 before the financial year’s first export

- Retention: Keep LUT acknowledgments for audits.

Secure e-FIRC

- Deposit Proceeds: After converting crypto, deposit funds with an AD bank.

- Obtain e-FIRC: Request electronic FIRC for each export transaction as proof of foreign exchange realization

Prepare and Issue Compliant Invoices

- Invoice Requirements:

- Mention “Zero-Rated Supply.”

- Include foreign currency value and LUT reference.

- Use correct SAC codes and invoice numbering

- Organization: Maintain invoice copies and correspondence chronologically.

File GST Returns Accurately

- GSTR-1: Report export invoices under Table 6B monthly/quarterly

- GSTR-3B: File without IGST payment if operating under LUT route

Claim Refunds

- Form RFD-01: File refund application for unutilized ITC (LUT) or IGST paid (bond route)

- Follow-Up: Monitor portal status and respond to queries promptly.

Maintain Records & Audit Trail

- Essential Documents:

- LUT and acknowledgments.

- e-FIRC copies.

- Crypto-to-fiat transaction statements.

- GST returns and refund correspondence

- Organization: Use folders or digital filing systems for easy retrieval.

Monitor Regulatory Updates

- CBIC Notifications: Follow CBIC circulars for GST export changes

- RBI/FEMA: Track RBI notifications on virtual currencies and FEMA provisions.

- Subscriptions: Subscribe to official newsletters (gstcouncil.gov.in, rbi.org.in).

Conclusion

A robust GST crypto export compliance checklist ensures you leverage zero-rated benefits and avoid notices. Follow these nine steps—verify eligibility, convert crypto, file LUT, secure e-FIRC, prepare invoices, file returns, claim refunds, maintain records, and monitor updates—to stay audit-ready and cash-efficient.

✅ Download our FREE “GST Crypto Export Compliance Toolkit” now to access templates, sample invoices, and an LUT filing guide.

Stuck somewhere?

Disturb us to help you out!

Harshaditya Kabra

+91-88277-53530

https://www.linkedin.com/in/ca-harshaditya/

https://accorgconsulting.com/