Introduction

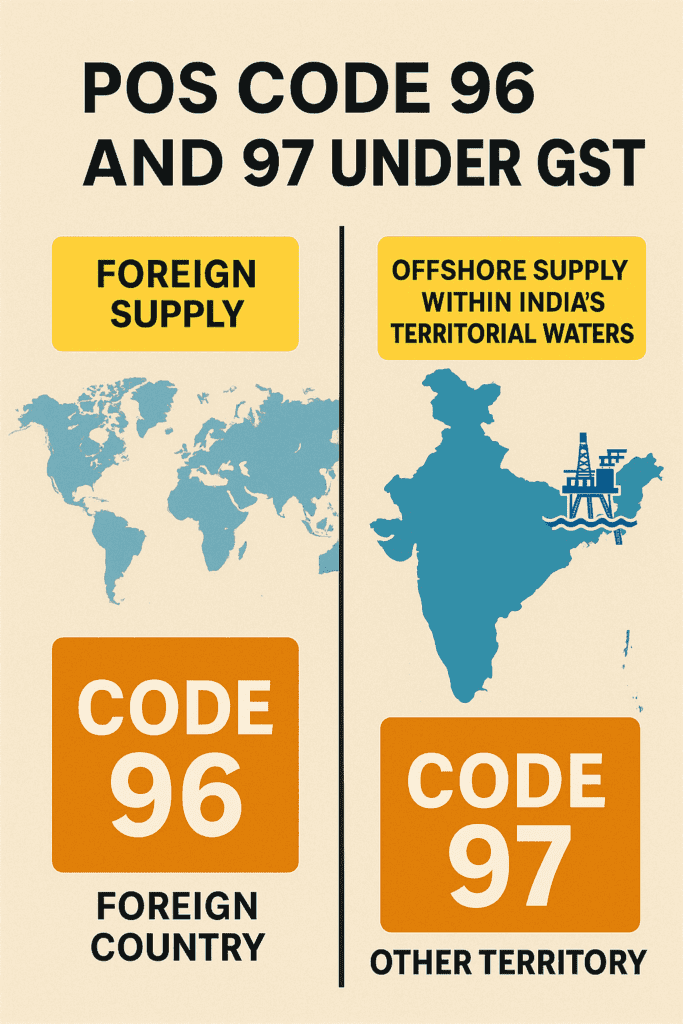

GST POS codes play a key role in taxing supplies correctly under India’s GST law. Code 96 flags inter-state supplies to foreign countries, while Code 97 flags inter-state supplies to Indian “other territories.” Moreover, using the right code ensures proper IGST treatment and ITC eligibility.

What Are GST POS Codes 96 & 97?

POS Code 96: Supplies to Foreign Countries

- Definition: Code 96 denotes a Foreign Country as the place of supply.

- When to Use: Apply when goods or services are delivered or performed outside India.

- Example: Courier services from a Mumbai taxpayer to a recipient in Germany use Code 96.

POS Code 97: Supplies to Other Territories

- Definition: Code 97 covers Other Territory within India but not assigned to any state code.

- When to Use: Use for offshore installations (e.g., oil rigs) and certain Union Territories without a state code.

- Example: Supply of equipment to an oil rig in India’s Exclusive Economic Zone uses Code 97.

Key Differences Between POS Codes 96 & 97

| Feature | Code 96 (Foreign Country) | Code 97 (Other Territory) |

|---|---|---|

| Jurisdiction | Outside India | Within Indian territorial waters or unassigned UTs |

| Section of IGST Act | Section 10(1)(a) – Exports | Section 10(1)(b) – Special domestic |

| Tax Treatment | IGST (exports) | IGST (treated as inter-state) |

| Common Use Cases | Exports of goods/services | Offshore supplies, unassigned UTs |

| Active voice, clear terms, and transition words improve readability. |

How to Choose the Right GST POS Code

- Identify the Recipient Location.

- If the recipient is outside India ⇒ Code 96.

- If the recipient is in an offshore or unassigned territory ⇒ Code 97.

- Check IGST Liability.

- Both codes lead to IGST, so confirm correct IGST head in your invoice.

- Validate in Your Billing System.

- Ensure your ERP/e-invoice tool dropdown lists both codes accurately.

Common Compliance Errors and How to Avoid Them

- Misclassifying Exports as Domestic. Always use Code 96 for exports

- Using Code 96 for Offshore Supplies. Use Code 97 instead.

- Omitting POS Code in JSON. In e-invoicing, POS must match transaction type (EXPWP/EXPWOP).

Tip: Add a validation rule in your invoicing software to block invoices with a blank or wrong POS code.

Conclusion

Correctly applying GST POS codes prevents tax disputes and ensures smooth ITC claims. Remember:

- Code 96 → Foreign Country (exports)

- Code 97 → Other Territory (offshore/unassigned UTs)

Ready to streamline your GST compliance? Download our free GST Invoice Checklist and never misclassify your GST POS codes again!

Stuck somewhere?

Disturb us to help you out!

Harshaditya Kabra

+91-88277-53530

https://www.linkedin.com/in/ca-harshaditya/

https://accorgconsulting.com/

Thank you for being of assistance to me. I really loved this article. http://www.kayswell.com