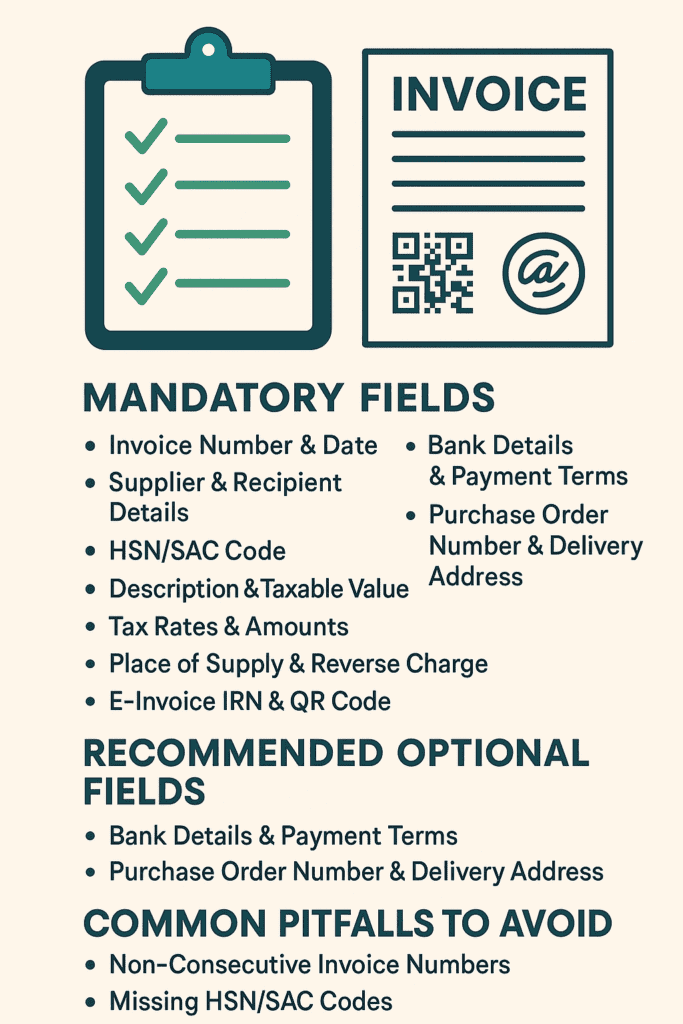

A comprehensive GST invoice checklist helps ensure every tax invoice complies with Rule 46 of the CGST Rules, 2017, and secures input tax credits for registered taxpayers. This checklist covers mandatory fields, e-invoice (IRN & QR code) requirements, recommended optional details, and common errors to avoid for seamless GST compliance.

Mandatory GST Invoice Fields

1. Invoice Number & Date

- Invoice number must be unique, consecutive, and ≤ 16 characters.

- Invoice date denotes the date of issue.

2. Supplier & Recipient Details

- Supplier details: name, address, and GSTIN.

- Recipient details: name, address, and GSTIN/UIN (if registered).

- State name & code for inter-state supplies.

3. HSN/SAC Code

- HSN code: 4-digit if turnover ≤ ₹5 Cr; 6-digit if > ₹5 Cr on B2B invoices.

- SAC code is mandatory for service providers.

4. Description & Taxable Value

- Description of goods/services, quantity, and unit.

- Taxable value after discounts or abatements.

5. Tax Rates & Amounts

- List CGST, SGST/UTGST, IGST, and cess rates & amounts

6. Place of Supply & Reverse Charge

- Specify Place of Supply with state name & code for inter-state

- Indicate if tax is under reverse charge mechanism.

7. E-Invoice IRN & QR Code

- Show the Invoice Reference Number (IRN) generated by IRP.

- Embed a scannable QR code with IRN and key invoice details.

Recommended Optional Fields

Bank Details & Payment Terms

- Bank account number and IFSC speeds up payment collection.

- Payment terms or due date set clear expectations.

Purchase Order & Delivery Address

- PO number links invoices to procurement orders.

- Delivery address if it differs from billing address.

Common Pitfalls to Avoid

- Non-consecutive or duplicate invoice numbers trigger compliance flags.

- Missing HSN/SAC codes can lead to return rejections.

- Omitting IRN or QR code on e-invoices invites penalties.

- Misreporting Place of Supply may attract IGST errors.

Ready to simplify your billing? Download our free GST Invoice Checklist template now and ensure 100% compliance.

Stuck somewhere?

Disturb us to help you out!

Harshaditya Kabra

+91-88277-53530

https://www.linkedin.com/in/ca-harshaditya/

https://accorgconsulting.com/