Introduction

First, follow this SME funding checklist to compile all required documents and data. Next, approach banks, fintech platforms, and venture-debt lenders with confidence. Finally, track each application and maintain transparency to fast-track approvals.

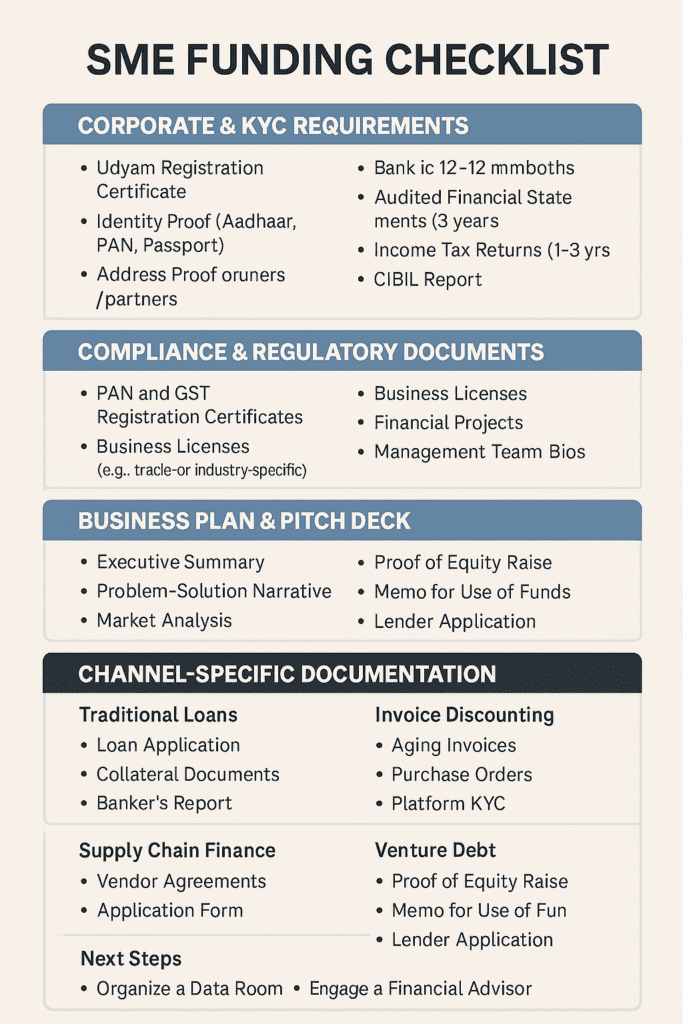

SME Funding Checklist: Corporate & KYC Requirements

- Udyam Registration Certificate

- Register on the Udyam portal; it replaced Udyog Aadhaar in 2020 and now hosts over 4.77 crore MSMEs .

- Identity Proof of Promoters (Aadhaar, PAN, Passport)

- Aadhaar is mandatory; PAN & GSTIN required for companies .

- Address Proof (Utility Bills, Rent Agreements)

- Banks must share a docs checklist at application time .

- Passport-Size Photographs & Board Resolutions

- Board minutes should authorize borrowings and collateral .

SME Funding Checklist: Financial Statements & Bank Records

- Bank Statements (6–12 months)

- Indicative checklist includes bank statements for appraisals .

- Audited Financial Statements (2–3 years)

- Income Tax Returns (2–3 years)

- Cash-Flow Statements & Projections

- Show 1–3 year projections tied to your funding ask .

- CIBIL/CRIF Credit Report (Score ≥650)

- Platforms like KredX require a 650+ score .

SME Funding Checklist: Compliance & Regulatory Documents

- PAN & GST Registration Certificates

- GST Returns (Last 6 months)

- Business Licenses (Trade/Industry-Specific)

- Incorporation Docs (MoA/AoA or Partnership Deed)

- Board Minutes Approving Funding

- NBFCs require detailed Diligence Packs .

SME Funding Checklist: Business Plan & Pitch Deck

- Executive Summary & Funding Ask

- Problem–Solution Narrative

- Market Analysis & Competitive Landscape

- Traction Metrics (Revenue, CAC, Retention)

- Financial Model & Use-of-Funds Memo

- Management Team Bios & Governance

- A sharp deck boosts lender confidence .

SME Funding Checklist: Channel-Specific Documentation

Traditional Bank/NBFC Loans

- Loan Application Form

- Collateral Papers (Title Deeds, Valuation)

- Banker’s Reference Letter

Invoice Discounting

- Aging Receivables & Purchase Orders

- Platform KYC & Turnover Proof (₹25 L+)

- Audited Books & 12-month Bank Statements .

Supply Chain Finance (SCF)

- Vendor/Supplier Agreements

- SCF Application & Credit Approval Letters

- Program-Specific Forms .

Venture Debt

- Equity Raise Proof (Term Sheet, Capital Call)

- Use-of-Funds Memo & Lender Application

- Pro-Forma Financial Model

- Pitch Deck & Company Diligence Pack .

Next Steps

- Organize a Secure Data Room

- Engage a Financial Advisor

- Track Application IDs & Follow Up

- Combine Channels: Use invoice finance for working capital and venture debt for growth.

Ready to fund your growth? Download the SME funding checklist or book a free consultation now to get personalized support and fast-track your financing.

Stuck somewhere?

Disturb us to help you out!

Harshaditya Kabra

+91-88277-53530

https://www.linkedin.com/in/ca-harshaditya/

https://accorgconsulting.com/