Introduction

The term startup equity and fundraising covers how founders allocate shares, set prices, manage cash burn, and raise capital in stages. This practical guide walks you through each step—ESOP setup, marketplace rules, SaaS pricing, burn‑rate metrics, and tranches—so you can execute a winning funding strategy.

What Is Startup Equity and Fundraising?

Startup equity and fundraising means:

- Issuing shares (equity) to employees and investors.

- Setting a fair price for your software (pricing tiers).

- Tracking cash outflows vs. revenue (burn rate).

- Raising capital in parts (tranches) to hit milestones.

Use this roadmap to align your team, attract investors, and stretch runway.

1. ESOP Planning for Early-Stage Startups

Why ESOP Matters

- Motivates employees by giving real ownership.

- Signals a culture of shared success to recruits.

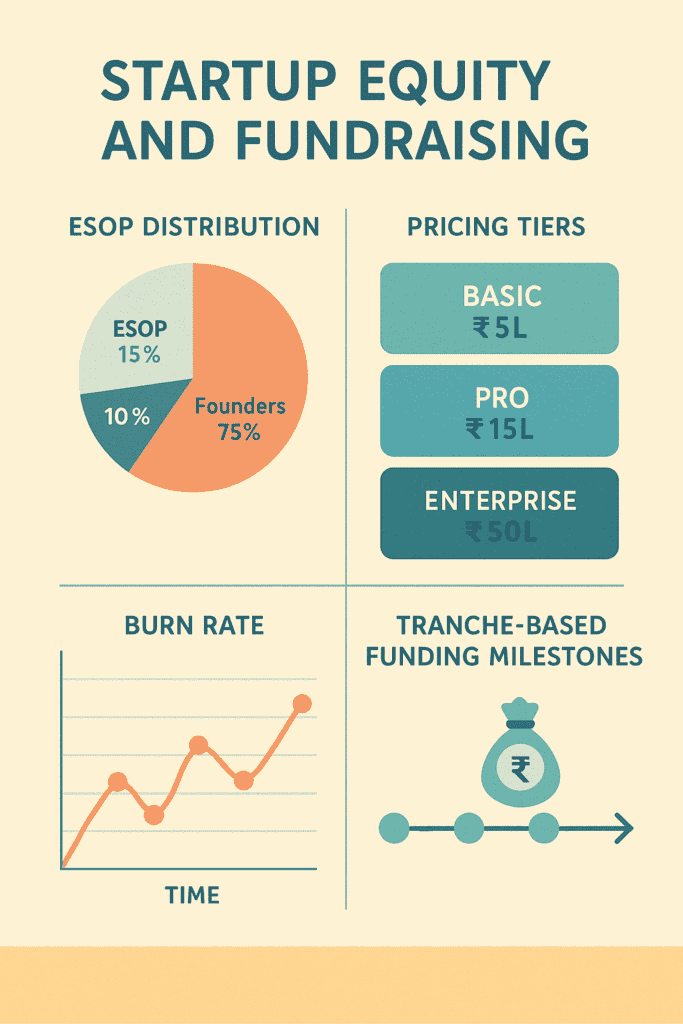

How Much Equity to Reserve

- Allocate 10–15% of fully diluted shares to the ESOP pool.

- Set up before your first big VC round.

Vesting & Exercise Terms

- Vesting: 3–4 years with a 1‑year cliff.

- Exercise window: 90 days post‑termination to keep it founder‑ and employee‑friendly.

2. Legal Framework for Indian Content Marketplaces

Key Regulations

- Consumer Protection (E‑Commerce) Rules, 2020: Disclose platform details & grievance officer; acknowledge complaints in 48 hours.

- IT Act 2000 Intermediary Guidelines & DPDP Act 2023: Clear takedown process, privacy policy, and data‑protection compliance.

- FDI Policy—Marketplace Model: 100% automatic‑route FDI allowed, provided you don’t hold inventory or fix prices.

Payments & Taxes

- Payment Aggregator Registration: Use RBI‑approved gateways or register as a PA under RBI’s 2020 guidelines.

- GST & TCS:

- Register for GST if turnover >₹20 L for services in normal states.

- Collect 1% TCS on each transaction for unregistered buyers.

3. B2B SaaS Pricing Strategy for SMBs

Initial Pricing Bands

- Small businesses: ₹5 L–15 L ACV

- Mid‑market: ₹15 L–50 L ACV

- Enterprise: >₹50 L ACV

Tiering & Evolution

- Start with three tiers: Basic, Pro, Enterprise.

- Review bi‑annually: Test usage‑based add‑ons and value‑based pricing as you scale.

4. Cash Burn & Cap Table Management

Burn Rate Metrics

- Gross burn: Total monthly cash outflows.

- Net burn: Outflows minus revenue.

- Runway target: 12–18 months.

- Efficiency goal: Spend <₹1.50 for every ₹1 of new ARR (net burn multiple <1.5×).

Cap Table Best Practices

- Use software (Pulley, Visible) for real‑time updates.

- Model scenarios: Plan dilution and ESOP refreshes ahead of each round.

5. Tranche-Based Fundraising Strategy

What Is a Tranche?

- A slice of total funding released upon milestone achievement.

Why Tranches Work

- Mitigates investor risk: Funds flow only when you hit targets.

- Aligns incentives: Keeps you focused on key KPIs.

Suggested Split for ₹1.5 Cr Seed Round

- First ₹75 L on signing: build AI engine & hire core team.

- Second ₹75 L on hitting milestones (10 000 paid users; ad‑monetization launch) within 6 months.

Conclusion & Next Steps

By following this startup equity and fundraising guide, you’ll:

- Retain top talent with a clear ESOP plan.

- Stay compliant in your marketplace.

- Price your SaaS to win SMB customers.

- Track burn for longer runway.

- Lock in funding tranches to de‑risk your growth.

Next Steps:

- Engage a startup‑focused lawyer to draft ESOP docs, T&Cs, and term sheets.

- Update your financial model with tranche triggers, burn targets, and dilution curves.

- Refine your pitch deck to spotlight milestones, clear runway, and tranche‑based risk mitigation.

Stuck somewhere?

Disturb us to help you out!

Harshaditya Kabra

+91-88277-53530

https://www.linkedin.com/in/ca-harshaditya/

https://accorgconsulting.com/